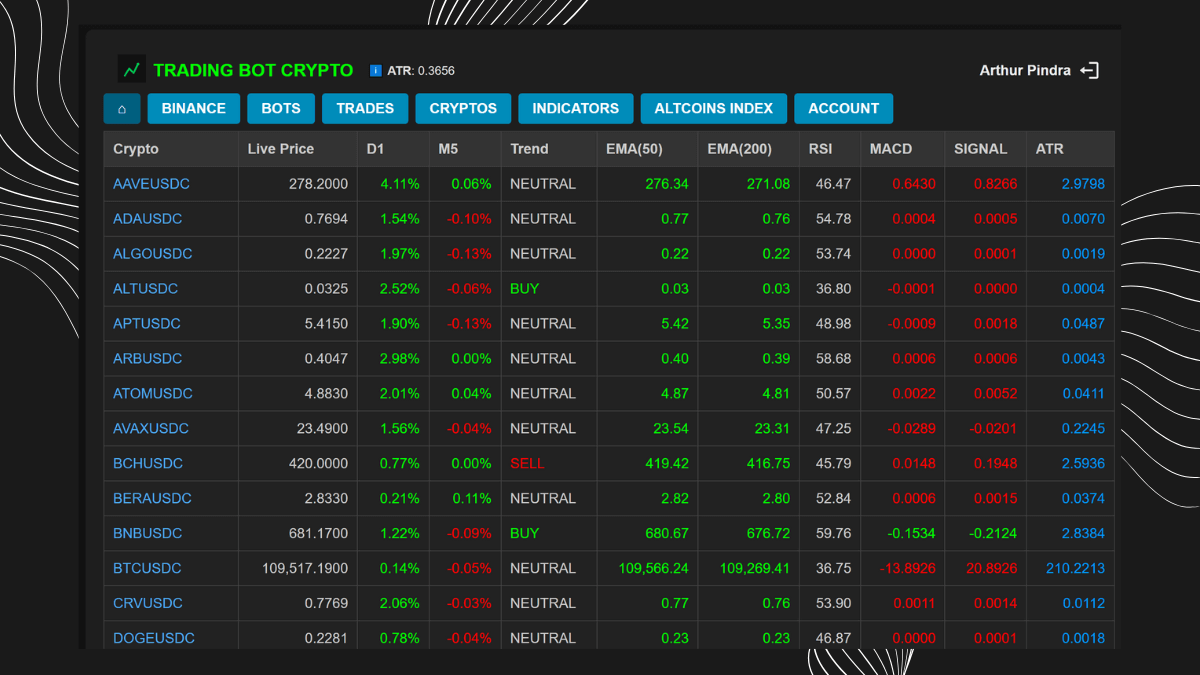

The ACI is a proprietary indicator made up of around fifty of the most popular cryptocurrencies. It measures overall altcoin market sentiment on a scale from –1 (SELL) to +1 (BUY).

• –1 indicates strong selling pressure

• 0 indicates neutral sentiment

• +1 indicates strong buying conviction

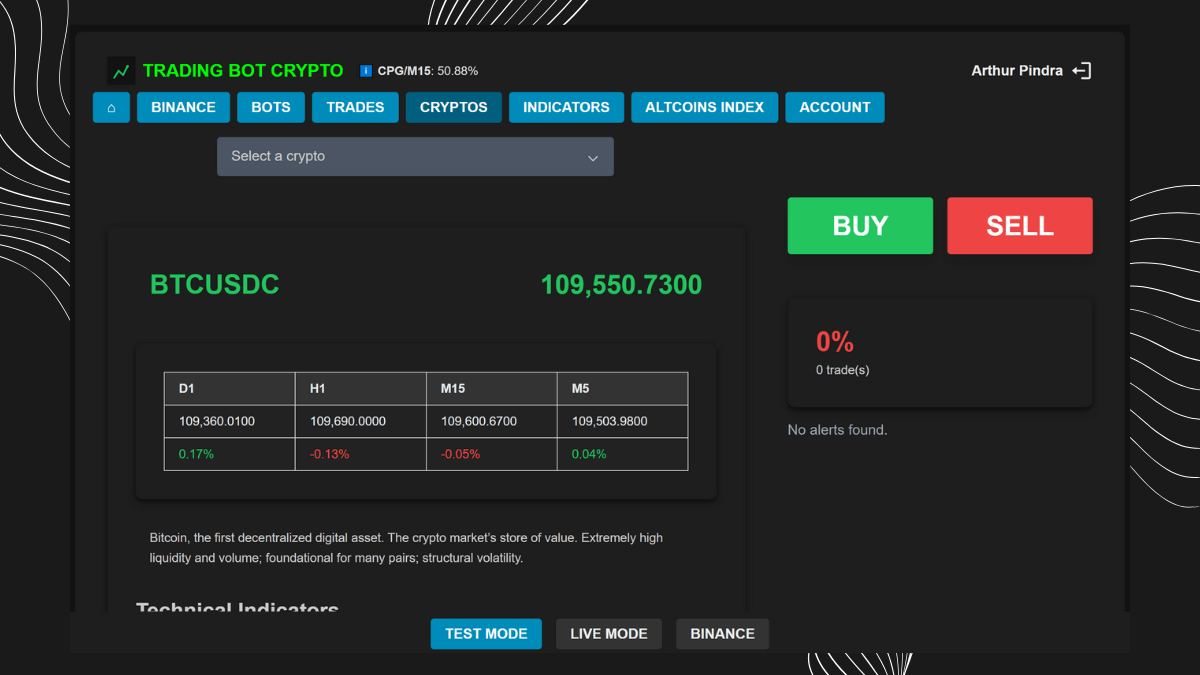

CPG (Crypto Percentage Green) shows the percentage of ALTCOINS INDEX assets that are up over various timeframes (M5, M15, and H1).

Other metrics derived from this Index include:

• The total VOLUME of the constituent cryptocurrencies at the current moment.

• ATR (Average True Range), which measures market volatility from 0 (low volatility) to 1 (high volatility).